January 9, 2015

Falling oil and gasoline prices should benefit most states financially, but there are a handful of states that will likely see significant revenue declines.

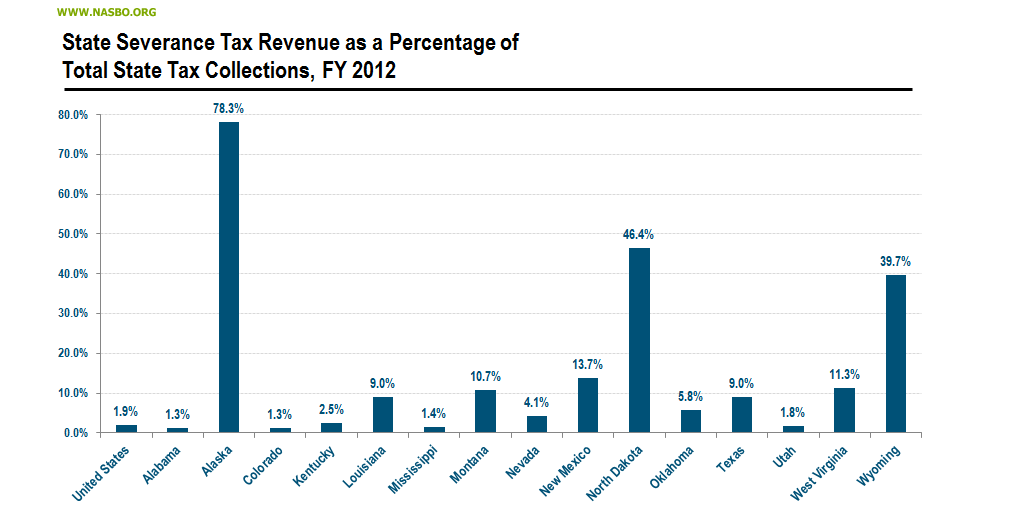

Most states tax the extraction of natural resources, such as oil, from within their jurisdiction. Taxes on natural resource extraction, also known as severance taxes, are imposed by states as well as the federal government. Severance taxes are determined by the value or volume (or some combination of the two) of the resource being extracted. Commodities that are subject to state severance taxes include oil, minerals, metals, natural gas, timber, fish and other natural resources. Overall, severance tax collections comprise a relatively small portion of total state tax collections. According to the U.S. Census, severance taxes accounted for 1.9 percent of total state tax collections in fiscal 2012. However, in a handful of states, severance tax collections represent a fairly large share of the state’s revenue. The dramatic price declines in the price of oil are likely to have implications for the overall budget in those states more reliant on severance taxes.

As a nation, oil price declines are likely to have a net positive effect for the economy; a phenomenon that will likely lead to increased economic activity and higher state tax collections. Mark Zandi, Chief Economist at Moody’s Analytics notes, “If we stay at $60 a barrel, consumers will save $150 billion on gasoline. It’s huge. If history is any guide, the bulk of that money will be spent and will drive economic growth.” Despite expected benefits from falling oil prices, severance taxes will decline in states that impose an oil severance tax. And for states more heavily reliant on oil severance taxes, increases in economic output and consumption will probably not be sufficient to offset the revenue declines attributable to the falling price of oil.

Most of the laws impacting oil production originate from the state level. States can tax oil production in different ways based on the volume and value of the oil being extracted. There is great variation of state severance taxes within the same commodity class and even more so across different commodity types. The Council of State Governments (CSG) has compiled a summary of state severance taxes by state, and the National Conference of State Legislatures (NCSL) has developed a compilation of oil and gas severance taxes by state.

The U.S. Census notes that 15 states do not collect severance taxes including Delaware, Georgia, Hawaii, Illinois, Iowa, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, South Carolina, and Vermont. Furthermore, Census data shows that in another 20 states, Arizona, Arkansas, California, Connecticut, Florida, Idaho, Indiana, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Carolina, Ohio, Oregon, South Dakota, Tennessee, Virginia, Washington, Wisconsin, severance tax collections accounted for 1.0 percent or less of the state’s total tax collections in fiscal 2012. For the remaining 15 states, severance taxes have greater importance for overall fiscal health, and the finances of Alaska, North Dakota and Wyoming are overwhelmingly driven by severance taxes. For Alaska and North Dakota’s budget, the commodity of importance is oil, and for Wyoming it is coal. The latest data on state severance tax collections compiled by the U.S. Census is from fiscal 2012.

The Census data does not report severance taxes by commodity, so it is difficult to know for sure how much revenue from severance taxes is directly attributable to oil as opposed to coal, natural gas or some other natural resource. However, the price of oil plays an important role in the budget for Alaska, North Dakota, Louisiana, New Mexico and Texas. States such as West Virginia, Wyoming and Kentucky are more reliant on severance taxes from coal rather than oil.

The effects of oil’s recent drop in price have rippled throughout financial markets as well as the world economy over the past several months. In all likelihood these effects will also be illuminated in future state severance tax collections. A handful of states will likely need to enact new spending plans that adapt to the lower market price now being offered for the world’s most valuable commodity. Although in general, the price of oil is not the most important ingredient of state revenue systems or the overall health of the national economy.